Advertiser Disclosure: We love living points life by using points and miles to elevate travel experiences. In the interest of being transparent with you, we may be compensated from an approved credit card's application, or from some of the products and services recommended on this site. This only happens when you click on our affiliate links. We also earn commissions from purchases made through Amazon Services LLC Associates Program. Thank you for your support and especially for reading this blog! Please see our Advertiser Disclosure for more details!

Making an advance deposit prepayment with World of Hyatt Hotels and Resorts is simple. Compared to HILTON and MARRIOTT, Hyatt makes the process easy to request and can be done online.

I’ll walk you through the steps in this post. Meanwhile, I’ll discuss why this Hyatt prepayment advance deposit using a credit card authorization form can be useful.

How to Make A Prepayment Advance Deposit With Hyatt?

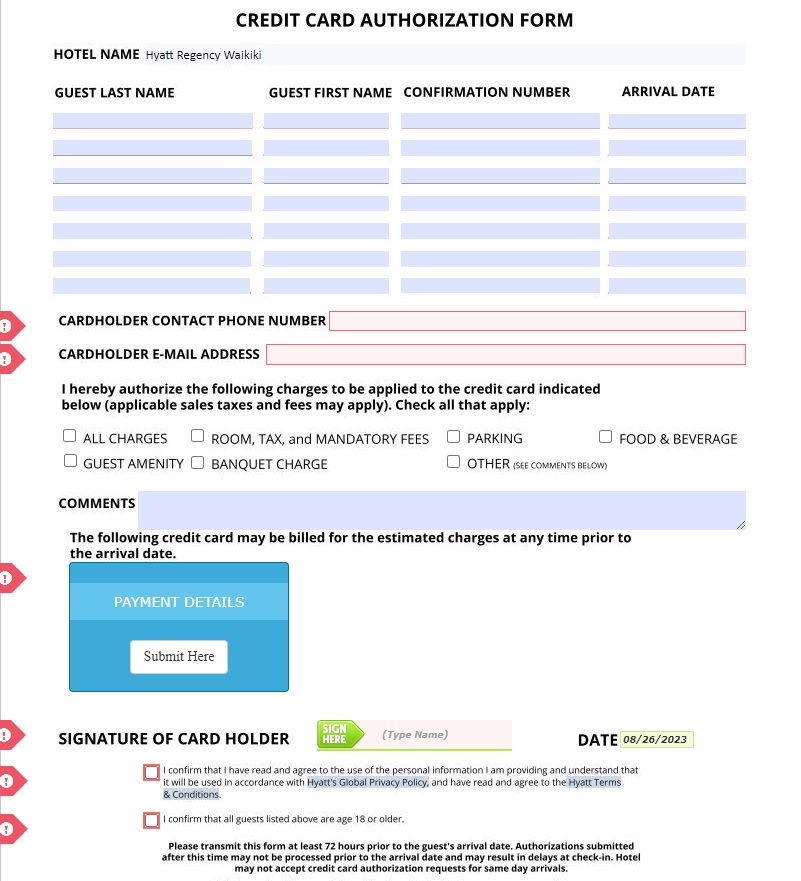

Unlike HILTON or MARRIOTT, you do not need to contact a Hyatt property to make a refundable advance deposit prepayment. You can make a request online through Hyatt’s credit card authorization form. Here are the steps:

- Go to the Hyatt Customer Service page.

- Click on the Credit Card Authorization Form.

- Provide the City or Hotel Name, and click the Find Hotel button.

- Select the Hyatt property that you wish to make a prepayment deposit.

- Be sure to enter the email address to receive confirmation of your completed credit card authorization form.

- Complete the credit card authorization form. In the Comments section, specify the amount you want the property to charge your card.

- Submit payment details with the credit card you want to use. See the image below.

- The Hyatt property processes the charge directly, which appears in your credit card account in a day or two.

Is the Advance Deposit Prepayment Refundable?

The concept of the prepayment arrangement is to have a credit card immediately charged for a specified amount before your stay date and have it applied to any charges you may or may not incur during your stay when you check out. Examples of charges include parking, dining, spa, and all other eligible charges you can charge to your room. Think of it like a “prepayment credit” in your room’s folio. You get a refund to the credit card if you do not use the whole credit or only use it partially during your stay. Similarly, if you cancel the reservation within the free cancellation window, you can also request to receive the full prepayment refund to the credit card.

Will Credit Card Company Claw Back the Credit On Refunds?

This is a valid question because the prepayment advance deposit is refundable. Hotels and resorts refund the prepayment advance deposit only to the used card.

Amex typically has the refund terms in writing. The following is the term for the American Express Hilton Aspire Card $400 Hilton Resort Statement Credit:

Note that statement credit(s) received during the reward year may be reversed if the eligible purchase is returned/cancelled, or if you engage in abuse or misuse in connection with the benefit (for example, if you do not maintain an eligible Card Account for the duration of the reward year).

Why is Prepayment Advance Deposit Useful?

Sometimes, you want to maximize your savings through credit card offers, such as the Amex Offers or the annual $100 Hyatt Credit on the Chase World of Hyatt Business Credit Card. Those offers have an expiration date that you must use the card to spend by, and therefore, being able to arrange a prepayment advance deposit can help in that scenario.

Suppose you have an upcoming Hyatt hotel and resort stay beyond the offer’s expiration date. In that case, you can prepay by using the credit card that contains the offer and have it charged immediately. In return, you’ll receive the statement credits from the credit card company and have the full prepayment credit to spend when your check-in date arrives.

For instance, I have the Chase World of Hyatt Business Credit Card with the $100 Hyatt Credit for each account anniversary year. However, I need to decide whether to keep or close the card. Meanwhile, I want to use the $100 Hyatt Credit if I cancel the card. I have a couple of upcoming stays at the Grand Hyatt Kauai Resort and Hana-Maui Resort, and those two stay dates happen far after the card’s annual fee due date, so I made a prepayment arrangement and had my card charged $50 each for each resort to receive the $100 Hyatt Credit benefit.

- Full List of Chase Ultimate Rewards Points Airline and Hotel Transfer Partners & Bonus (2025) - February 9, 2025

- 10 Best Dell Products to Buy With Your Amex Business Platinum Credit - February 9, 2025

- Best Credit Card Signup Bonus Promotions and Offers (February 2025) - February 9, 2025