Advertiser Disclosure: We love living points life by using points and miles to elevate travel experiences. In the interest of being transparent with you, we may be compensated from an approved credit card's application, or from some of the products and services recommended on this site. This only happens when you click on our affiliate links. We also earn commissions from purchases made through Amazon Services LLC Associates Program. Thank you for your support and especially for reading this blog! Please see our Advertiser Disclosure for more details!

Getting your foot in the door of points travel can be exciting and overwhelming at the same time, but always remember that the quickest way to earn several miles and points is through the card’s introductory sign-up bonus. It is not spending on credit cards and finding yourself in debt trouble. That will defeat the whole purpose of this hobby.

Therefore, here are three (3) principles to remember as you start:

- Focus on getting the credit card’s sign-up bonus points and miles.

- Always spend on what you will spend anyway, such as meeting the spending requirements to get the sign-up bonus.

- Determine the card’s ongoing perks that are worth the annual fee. If it does not provide any valuable benefits, close it after year one.

Capital One Venture X Card

The Capital One Venture X Credit Card is an all-around great card for travel. The card comes with a shockingly high $395 annual fee. However, if you enjoy traveling, you’ll appreciate the $300 travel credit on this card that you can use to book a hotel, flight, and rental car through the Capital One travel portal. Therefore, the card’s annual fee is really $95 if you can use the $300 travel credit each year. It is $300 you would spend anyway on travel.

Furthermore, for a $95 Venture X Card, you get several other card benefits, such as airport lounge access for free food and drinks, including alcoholic beverages, Global Entry (GE) or TSA PreCheck statement credit, Hertz President’s Circle status, no foreign transaction fees when you travel abroad, 2X miles on everyday purchases, and those miles can convert to airline miles or hotel points that partner with Capital One. All in all, if you are serious about travel and points, this card is excellent.

Chase Sapphire Preferred Card

Many travel bloggers recommend the Chase Sapphire Preferred Credit Card because it offers good travel perks for a low annual fee of $95. The card also offers a $50 hotel statement credit, which you can use to book a hotel through the Chase travel portal, reducing the annual fee to only $45.

One of the great perks of the Chase Sapphire Preferred Credit Card is the primary rental car insurance globally, which means it pays out before your secondary or personal insurance coverage. In addition, the card earns 2X points on all travel purchases and 3X points on all dining purchases. You can transfer those points to airlines and hotels, such as United, Southwest, HYATT, IHG (InterContinental Hotels Group), and MARRIOTT, to name a few.

However, unlike the Capital One Venture X Credit Card, the Chase Sapphire Preferred Credit Card does not offer airport lounge access, Global Entry (GE), or TSA PreCheck fee credit.

Airlines Credit Cards

I don’t normally recommend airline credit cards unless they offer value to each individual. Getting an airline card depends heavily on the airlines you always fly with and whether or not you like to check bags.

For example, if you frequent United Airlines, you may want to consider the Chase United Explorer Credit Card. The card has a $95 annual fee, but you’ll get it waived for the first year as part of the introductory sign-up offer. Moreover, you get free checked bags for you and your companion and two club passes each year. The checked bag fee with United costs $40 one way, so if you check a bag on a round-trip ticket, that is enough to pay for the card’s annual fee and enjoy other perks, such as priority boarding, United Clubs access, etc.,

If you are interested in a specific airline credit card and would like to ask me questions about it, feel free to email me at thepointslife at gmail dot com. Meanwhile, check out the following Full List of Airline Credit Cards:

Full List of Airline Miles Credit Cards

Hotels Credit Cards

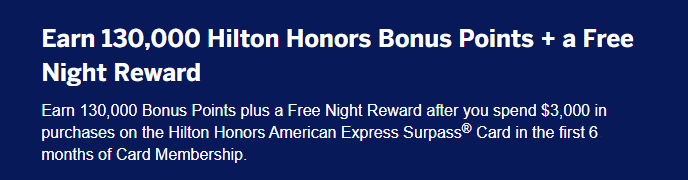

Hotel cards are another credit card that can be valuable. The hotel card that’s favorite among points enthusiasts is the $95 Chase World of Hyatt Credit Card because the Hyatt points redemption remains much lower than other hotel chains. But the hotel card also offers a free night each year to justify the card’s annual fee, so people like to hold on to the card for that reason. In addition, some hotel credit cards, such as the American Express Hilton Aspire Card, offer you the highest Hilton Diamond status and free night each year, and the American Express Marriott Bonvoy Brilliant Card also offers you the Marriott Platinum status and free night each year.

Still, having a hotel credit card requires flexibility if you only have one free night to use, such as having to switch hotels/resorts after the free night. But it’s great if you want to stay one night free somewhere. Better yet, plan accordingly with the member(s) of your household to get the card as well, and you can combine the free nights.

If you are interested in a specific hotel or resort credit card and would like to ask me questions about it, feel free to email me at thepointslife at gmail dot com.

Full List of Hotel and Resort Points Credit Cards

Purchasing Points

Besides travel reward credit cards, there’s another option: purchasing points. You basically buy points and then redeem them. In this way, you will spend money to buy points, but you will save money compared to buying the travel outright. Let me clarify this with a real-world scenario:

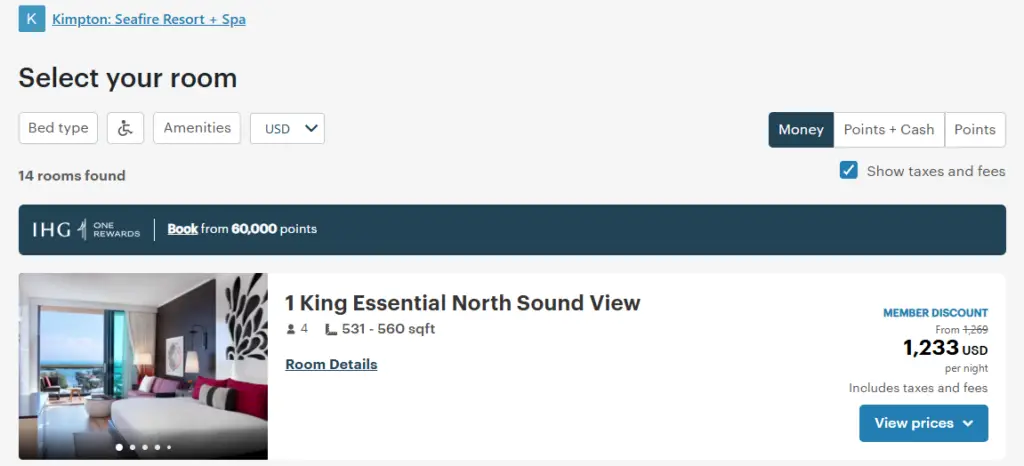

Suppose you want to go to the Grand Cayman and stay at the Kimpton Seafire Resort & Spa.

- The date that I used for the example shows one night there, including all taxes and fees, which cost $1,233 per night.

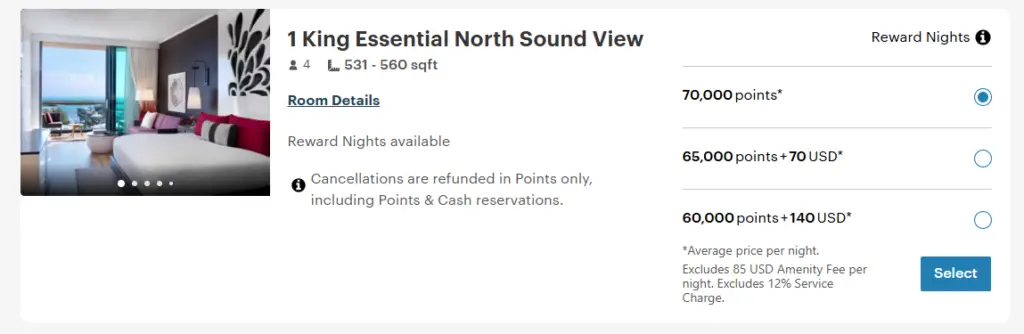

- If I want to redeem points instead, it costs 70,000 IHG points per night plus $85 inclusive of tax and a 12% Service Fee per room each night.

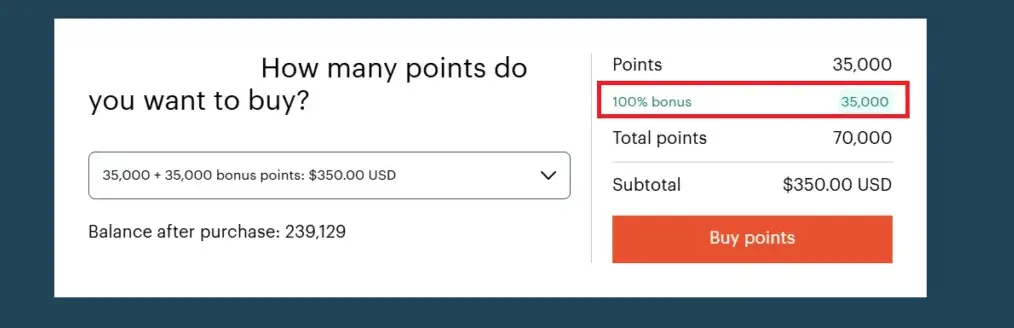

- I purchase IHG points during the 100% bonus sales (IHG has this sale very frequently), and it costs me $350.

Therefore, would you rather pay $350 plus resort fees or $1,233 per night? As you can see, you can substantially save money by buying points to redeem for the night instead of paying for the room outright. All known hotel chains have point sales, and all airlines have miles sales as well.

There are a couple of things to remember:

- It’s always important to compare the nightly rate vs. the money you spend to buy points.

- If you can, buy points during sales, such as a 50% discount or 100% bonus. The following blog post lists all available miles and points for sales-related deals.

- Full List of Bank Bonus Promotions and Offers (2025) - April 22, 2025

- Full List of Hyatt Promotions and Offers (2025) - April 21, 2025

- Full List of Citi ThankYou Points Airline and Hotel Transfer Partners & Bonus (2025) - April 21, 2025