Business Credit Cards can offer great signup bonuses and ongoing reward perks. However, you may not realize that you can get a business credit card without a business.

In this post, I will answer a few commonly asked questions and walk you through how to apply for a business credit card without a business tax ID.

Can you get a business credit card without business?

The term “Business” is very broad. You do not need to own a corporation, an LLC, or a company to get a business credit card. In fact, you do not need to have an Employer Identification Number (EIN) or hire employees to get a business credit card.

As far as credit card issuers are concerned, you have a business when you perform work that is outside of your daily full-time job, and that work generates an income, whether it’s small or large. For example, if you sell items on Facebook market, eBay, Amazon.com, at a local market, yard sale, and so on, you are qualified to apply for a business credit card. Similarly, if you dog walk, dogsit, babysit, or perform contracting work such as freelancing, you are qualified to apply for a business credit card.

The gist of it is as long as you perform a task that creates monetary profit or loss, that task is considered your business. Therefore, you can get a business credit card with your Social Security Number instead of an Employer Identification Number. More below.

To clarify, you must always provide truthful information about your business on a business credit card application form. Remember, it does not matter what type of work you do on the side or how much revenue you make; answer the credit card application questions to the best of your knowledge, even if your side business has zero income or your business is a startup business with no income yet.

Can you get a business credit card with no revenue?

Yes, absolutely.

Credit card banks do not decline your business credit card request because your business does not make any money. There are more criteria that each bank is looking for, such as your personal credit health, your relationship with the bank, and so forth, to review and approve you.

Can I get a business credit card without EIN?

Yes. Provide your Social Security Number (SSN) on the business credit card application as your business tax ID.

Can I get a business credit card without an LLC?

Yes. In that case, apply for the business credit card as a sole proprietorship. See below.

Can you get a business credit card as a Sole Proprietorship?

Yes, absolutely.

In fact, when you do not own a business with an EIN, do not have a corporation, or own an LLC, your small side hustle business would fall under the Sole Proprietorship category. In that case, your SSN is your business tax ID.

Can I get a business credit card with bad personal credit?

Unfortunately, bad personal credit may increase your risk of banks rejecting your business credit card application. Generally, when you apply for a business credit card, banks ask for your Social Security Number and employment income in addition to your business information.

Do business credit cards affect your personal credit?

Yes, but it’s not a huge impact. The credit impact of applying for a business credit card is similar to applying for a consumer credit card.

When you apply for a business credit card, your personal information is also required. Therefore, banks may perform a hard inquiry on your personal credit report. However, when you are approved for the card, it is not reported to the credit bureaus on your personal credit report, with the exception of Capital One, because they also report their business credit card to your personal credit report.

Related Post:

How to get a business credit card without using personal credit?

Unfortunately, that is impossible.

How to apply for a business credit card without a business?

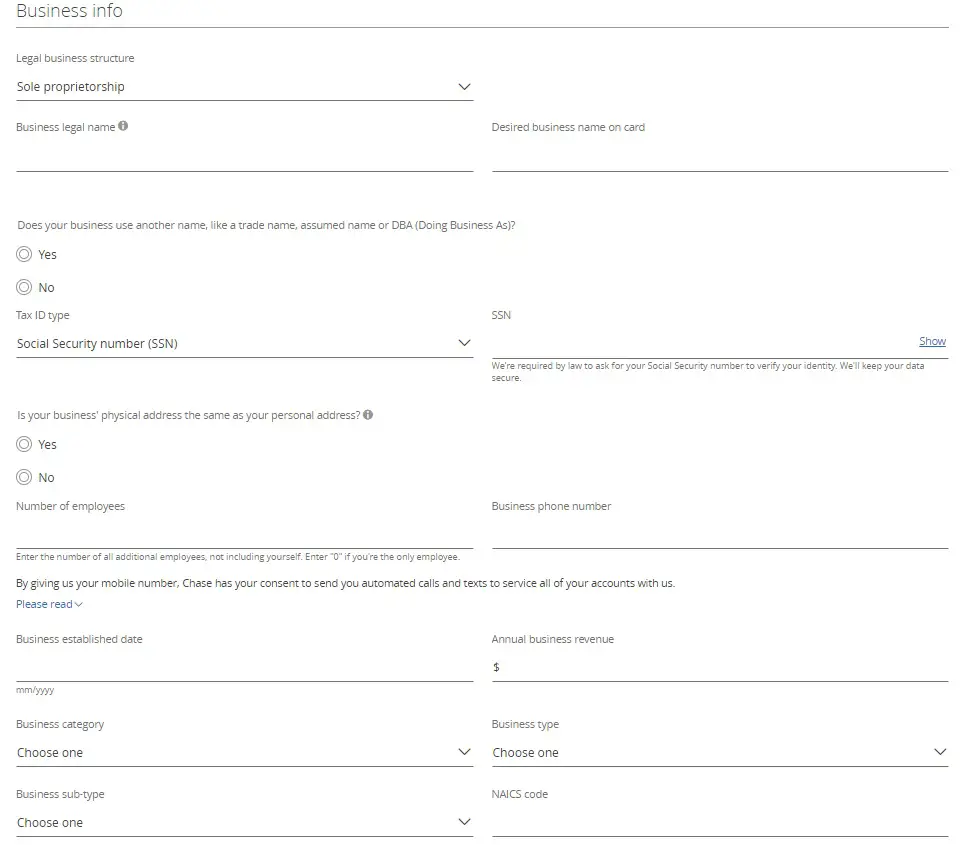

Business credit card issuers will ask similar questions when you apply for a business credit card.

- You will be asked to provide your personal information, including your Social Security Number and employment details.

- Then, you are asked to provide your business details, such as the business name, type of business structure, employee numbers, business tax ID, business established date, business revenue, and category. If you do not have a business but just side work:

- Your business name is your Full Name.

- The business structure is Sole Proprietorship.

- The business tax ID is your Social Security Number (SSN).

- Your business revenue does not have to be a huge amount. It can be a few dollars or zero if it really does not generate any income.

- Finally, read all the card terms and fees and submit the credit card application accordingly.

- After that, if your application is approved, congratulations. If it is not approved, call the bank’s business credit card reconsideration line and be ready to answer truthfully about what you do and the revenue pertaining to your business.

How to get a business credit card for a new business (startup)?

The process to get a business credit for a new business or a startup is the same as getting a business credit card for other types of businesses. You apply and complete the credit card application form and provide honest answers to your startup-related questions, even if it has not generated any income yet. In that case, you put in zero for the business revenue section. Remember, banks approve a business credit card applicant based on other factors and not the business revenue.

Can I get a business credit card for personal use?

There are no written terms that prevent you from using a business credit card for personal expenses. You are responsible for paying any balances like you were with personal credit cards. However, there’s one condition that’s worth noting is that, certain business credit card benefits may apply only when you make purchases that relate to your business. For example, Chase Ink Business Preferred Credit Card offers the primary rental car insurance for business trips only.

Best Business Credit Cards (2024)

Whether you are a small business owner or you are looking for the best business credit cards for your new business startups, cashback, travel, rewards, etc. You want to look for these three (3) things:

- The card’s signup bonus rewards.

- Ongoing rewards structures and perks.

- With or without an annual fee.

- Certain business credit cards offer great ongoing benefits that may outweigh the card’s annual fee.

The following business credit cards currently offer the best signup bonus rewards with no annual fee. However, these offers are ending on January 18, 2024.