Chase is one of the credit card banks that offer great sign-up bonuses on their credit cards. Unfortunately, Chase has tightened their application rules process that has a significant impact on the miles and points community with credit card sign-up strategies.

|

| Photo Credit: Chase |

| Table of Contents [show/hide] |

|

|

What is Chase 5/24 Rule?

First of all, the “Chase 5/24 Rule” term is referred to by the miles and points community. Chase bankers and Chase customer representatives mostly are not familiar with this terminology.

Chase 5/24 Rule states the following:

- If you have 5 or more new credit card accounts with Chase or any other banks in the past 24 months, Chase will not approve your new application.

How does Chase 5/24 work?

Once you submit your new Chase credit card application, your credit report will be pulled. If Chase sees that you have 5 or more open/closed credit card accounts with Chase or any other banks in the past 24 months on your credit report, your new Chase credit card application will be declined.

Does the authorized user card count towards Chase 5/24?

Recommended Post:

Does Chase 5/24 apply to charge cards?

Does Chase 5/24 apply to store cards?

Does Chase 5/24 apply to business cards?

Does Chase 5/24 Apply to Loans?

Does product change count towards Chase 5/24?

How to check your Chase 5/24 status?

Exceptions to Bypass Chase 5/24 Rule

In Branch Pre-Approval Offer

Stop by a Chase branch and ask the banker to search for pre-approval offers for you. If there’s any pre-approval credit card offer, you can tell the banker to make an application for you and that will bypass the Chase 5/24 rule.

In Branch Paper Application With A Business Relationship Manager

If you really want to apply for a Chase business credit card and you have over 5 business cards on your business credit report in the past 24 months, you can ask your Chase Business Relationship Manager to make a paper application for you to bypass the Chase 5/24 rule.

Mail Invitation With RSVP Code

Chase does send out invitation letters with an RSVP code to consumers to invite them to apply for Chase branded credit cards. If you receive one of those invitation offers, the RSVP code you use to apply for a Chase credit card will make your application bypass the Chase 5/24 rule.

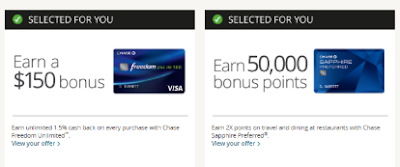

Online Targeted Just For You

- Log into your Chase account.

- On the left-hand side where the 3 lines menu ☰ icon is, click on it.

- Click on “Just for you” under the Explore Products section.

That will take you to another page that has your targeted offers.

If you see a credit card offer that has a green checkmark with the word SELECTED FOR YOU, then you can apply for that credit card and your application will not be subjected to the Chase 5/24 rule.

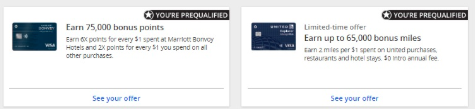

Online Targeted Credit Card Offers

- Log into your Chase account.

- On the left-hand side where the 3 lines menu ☰ icon is, click on it.

- Click on “Credit cards” under the Explore Products section. That will take you to another page that has Chase credit card offers.

If you see the words YOU’RE ALREADY APPROVED or YOU’RE PREQUALIFIED next to a credit card offer, then you can apply for that credit card and your application will not be subjected to the Chase 5/24 rule.

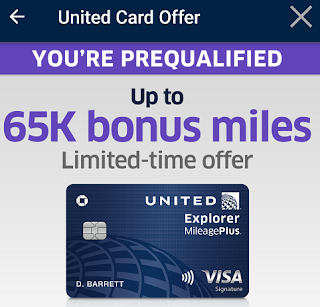

Online Targeted With United App

- Launch the United app.

- On the homepage, click on the United credit card offer ad.

- Check whether the offer has the YOU’RE PREQUALIFIED word on the top. If it does, your application will not be subjected to the Chase 5/24 rule.

Fixed APR Term

The miles and points community has provided data points that if a credit card offer that you are pre-qualified for has a fixed APR stated in the term, then your application will bypass the Chase 5/24 rule. If your offer has an APR range term, then that will not bypass the Chase 5/24 rule.

Fixed APR Term that will bypass Chase 5/24 rule: 0% fixed Intro APR for the first 12 months that your Account is open. After that, 14.74%. This APR will vary with the market based on the Prime Rate.

APR Range Term that will not bypass Chase 5/24 rule: 0% fixed Intro APR for the first 12 months that your Account is open. After that, 14.74% to 20.74%, based on your creditworthiness. These APRs will vary with the market based on the Prime Rate.

I recently added my husband as an authorized user on my Chase Amazon card. HOWEVER, that account was opened in 2017, and I'm pretty sure that it would not count towards the 5/24 rule today (6/3/22) because it would not show as a new account from the past 2 years. Does that sound correct?

I'm going to try it and will let you know the results!

Adding an authorized user to a card does not count towards your 5/24. It will be counted towards the 5/24 for the AU, in this case, your husband’s application. However, if his application is denied because of that, just let chase know it’s an AU card. If you are applying for the card for yourself, then you are fine because that card was open since 2017. Good luck!

Just an update. Husband's card was approved with no problems. Thanks.