UPDATES:

- Friendly Reminder: Make sure to double-dip the $300 Marriott Bonvoy statement credit before September 22, 2022, mentioned below. Use the ideas in this article to spend your $300 Marriott statement credit.

- From September 22, 2022, Amex will replace the $300 Marriott Bonvoy statement credit with a monthly $25 dining statement credit. This also opens up a double-dipping opportunity. Suppose you are approved for the American Express Marriott Bonvoy Brilliant Card before September 22, 2022. In that case, you can max out the current $300 Marriott Bonvoy statement credit and take advantage of the monthly $25 dining credit for almost a year after September 22, 2022!

American Express Marriott Bonvoy Brilliant Card offers a $300 statement credit each year during card membership for eligible

purchases at worldwide Marriott Bonvoy hotels and resorts. The Brilliant card is

one of the premium travel cards with a high annual fee of $450, and being

able to use and maximize its $300 statement credit benefit will help justify

that yearly fee.

credit benefit easier to use than the

$250 Hilton resort credit that comes with the Amex Hilton Aspire card.

Marriott Bonvoy statement credit.

|

|

| Protea Hotel Cape Town Waterfront Breakwater Lodge |

| Table of Contents [show/hide] |

|

|

Use the Credit For Dining & Restaurants From September 22, 2022

Use the Credit For Staying at a Marriott Bonvoy Property

This is the most obvious and straightforward way to use the $300 Marriott Bonvoy

statement credit, and that’s exactly what the benefit was designed for.

- You stay at

a Marriott property and use your Amex Marriott Bonvoy Brilliant card to pay for

room rate, dining, spa, and any incidental charges at participating worldwide

Marriott Bonvoy hotels, resorts, and timeshare properties. - You just have to ensure all expenses are charged to the room and paid for with your American Express Marriott Bonvoy Brilliant Card at the time of checkout for the benefit to apply.

- American Express will

automatically issue a $300 statement credit into your credit card’s account.

Use the Credit For Night Out at a Marriott Bonvoy Property

Staying with Marriott Bonvoy property is not required. You can have a night out

in the town where your local Marriott Bonvoy property has a restaurant or a bar. Any

Marriott Bonvoy brands such as Courtyard, Fairfield Inn, Sheraton, Westin, etc., will do.

statement credit once or twice by having a date night out to eat and drink

at a local Courtyard property. Amex reimbursed our food and drinks expenses and applied the $300 Marriott Bonvoy statement credit. You just need to pay with your American Express Marriott Bonvoy Brilliant Card for this benefit to apply.

Use the Credit For Reservation Deposit

Some Marriott Bonvoy properties require a credit card deposit when making a

reservation. One of the properties we know about is the

Le Meridien Bora Bora Resort. We made a points and cash reservation that came with a flexible

cancellation policy. Right after our reservation was made, the property charged our credit card. We contacted the property right away, and they responded

below:

Thank you for your email. I checked with our reservation department

regarding this charge. They confirmed that according to your booking policy,

this amount is for the deposit regarding your booking by cash and points. If

you will not use this deposit during your stay, we would like to confirm

that we will refund this amount to your bank account after your

departure.

So what this means is that you can make a refundable reservation with one of these Marriott Bonvoy properties that require a reservation

deposit with your American Express Marriott Bonvoy Brilliant Card, and your credit card will be

charged right away for the deposit. This will trigger the $300 Marriott

statement credit because the charge is processed directly by a participating Marriott

Bonvoy property. After a while, if your trip is interrupted, you can cancel the

reservation during the permitted time and get the deposit refunded to your Amex

Brilliant credit card.

What Happens to Refunded Credit?

Marriott Bonvoy Brilliant $300 statement credit terms. So please

proceed carefully with this trick at your own risk, as Amex may be clawing

back canceled/returned credits in the future. You have a full

membership anniversary year to use this $300 credit, so go travel and

enjoy the credits. But if you must use this trick, use it as a last resort. This is what Amex says:

Note that statement credit(s) received during the reward year may be

reversed if the eligible purchase is returned/cancelled, or if

you engage in abuse or misuse in connection with the benefit (for example,

if you do not maintain an eligible Card Account for the duration of the

reward year).

We put this trick to the test and haven’t had any issues. However, don’t do it too

often to the point that you are abusing this trick. Obviously, suppose you have a legit

upcoming stay. In that case, you will likely spend money at the hotel for

parking, food, drinks, room rate, taxes, etc.; these charges qualify

for the $300 Marriott Bonvoy statement credit benefit. Consider doing this

only if it were your last resort because this benefit is one of those things you use or lose.

Use the Credit For Marriott Gift Card

Data points from the points and miles community indicate that purchasing a Marriott

gift card does trigger the $300 Marriott Bonvoy statement credit

reimbursement. This is, in fact, true when you can find a local Marriott Bonvoy

hotel that can sell a Marriott gift card to you because the payment will be

processed directly by the property. However, the challenging part is

finding a local Marriott property that actually sells Marriott gift cards.

- Via the comment section, a reader pointed out that Amex added a section “Online purchases of Marriott branded gift cards do not qualify as eligible purchases for this benefit.” However, a data point via FlyerTalk shows that online Marriott gift cards purchase still trigger the credit, and the data point was provided in October 2021. Always try something small before committing, just in case.

statement credit can be done online. However, you must buy it

directly from the Marriott website

here.

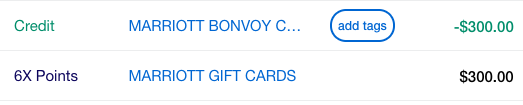

Marriott e-gift card, and Amex automatically issued us a $300 statement credit. The

transaction even earns 6x points per 1 dollar spent. So apparently, the charge

was coded as if the payment was processed by a Marriott Bonvoy property. See the screenshot below.

Use the Credit For Shop Marriott

- Data points via FlyerTalk show that online purchases through Marriott Bonvoy stores trigger the credit. There’s no need to purchase a Marriott gift card with the credit first, then pay for Shop Marriott as this article was initially written. Always try something small before committing, just in case.

- Use the Marriott $300 statement credit to purchase a Marriott gift card or an e-gift card. See the Use the Credit For Marriott Gift Card section above.

- Go to a Marriott Bonvoy brand’s online store to shop for hotel bedding.

- Shop Marriott

- The Ritz-Carlton Shops

- Curated by JW

- Collect Renaissance

- Gaylord Hotels Store

- Shop Courtyard

- St. Regis Boutique

- W Hotels Store

- Westin Store

- Sheraton Store

- Fairfield Store

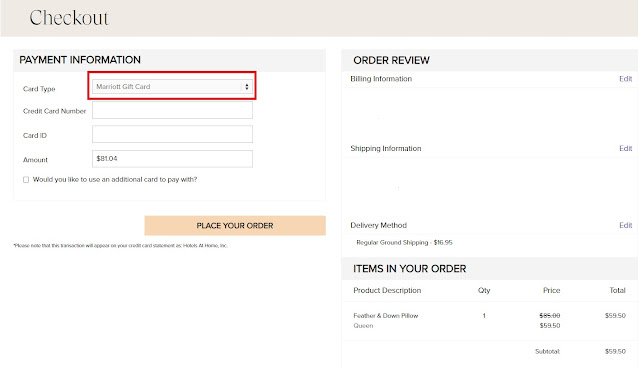

- At checkout, follow the screen to pay. On the final page, select Marriott Gift Card for payment. See the screenshot below.

|

| Marriott Bonvoy Brilliant $300 Statement Credit Shop Marriott |

Maximize the Credit With Amex Offer

With the Amex offer, you can maximize your $300 Marriott Bonvoy statement credit savings even further. You can stack the methods mentioned above with the Amex

offer.

Here’s how it works. Check your Amex Offers from time to time to see if your

American Express Marriott Bonvoy Brilliant Card is targeted for any statement credits at a participating

Marriott Bonvoy brand. For example, my Brilliant card was targeted for spending

at Marriott brand property: Spend $300 or more, get $60 back.

specific about which Marriott Bonvoy brand or property is eligible, so be sure

to check the fine print.

There you have it! I hope you enjoy learning these ways to take full

advantage of your American Express Marriott Bonvoy Brilliant Card‘s benefit, and subscribe to our blog posts below to learn more tips & tricks

on points traveling!

Is check-in at hotel required for using the 300 USD credit? Any proof that a check in is not required. Their terms and conditions reads that all expenses like spa, dining, etc. must be billed to the room upon check-out…

Hi, why would you want to book a stay and not check-in/use $300? If you are gifting the room to someone or if you cannot personally check in, you can add a second guest to your reservation that can check in for you, but be sure to contact the property to arrange the payment using your Brilliant card first. If you can't be there at all, you can read about reservation deposit in this article under "Use the Credit For Reservation Deposit" so the guest that is staying in the room is not being charged.

FYI – In 2021 Marriott seems to have changed the online gift card reimbursement. I purchased a Marriott online gift card in 2020 and got $300 back (Bonvoy Brilliant card benefit) but wary this year. https://www.americanexpress.com/us/credit-cards/card-application/apply/prospect/terms/marriott-bonvoy-brilliant-card/25330-10-0

Here's the part – (Note the last line)

$300 Marriott Bonvoy Statement Credit

During each year of your Card Membership ("reward year"), you are eligible to receive up to $300 total in statement credits on your Card Account for eligible purchases made directly at hotels and timeshare ownership properties participating in Marriott Bonvoy on your Marriott Bonvoy Brilliant™ American Express® Card during that reward year. Your first reward year begins on your account opening date. Each subsequent reward year begins on the anniversary of your account opening date.

Eligible Marriott Bonvoy property purchases must be made directly with the participating Marriott Bonvoy property and charged to your Marriott Bonvoy Brilliant American Express Card account for the benefit to apply. Incidental charges (including charges made at restaurants, spas and other establishments within the hotel property) must be charged to your room and paid for with your Marriott Bonvoy Brilliant American Express Card at checkout in order to be recognized as Marriott Bonvoy purchases.Online purchases of Marriott branded gift cards do not qualify as eligible purchases for this benefit.

Hey PL, checking in on this one to see if anyone has managed to trigger this credit for online Marriott Gift Card purchases?

I was able to do so in 2020 and getting conflicting data points on whether or not you still can despite the change in the T&Cs wording that another anonymous poster pointed to above.

The latest DP I could find is through FlyerTalk. It appears that the online gift card purchase still triggers the credit for that Flyertalk member, and the DP was provided in October 2021 (reference link is included in the post). Try to use the credit for what the credit is intended for before doing the gift card as the last resort. If you must, always try something small before committing.