Capital One allows you to refer a friend to a particular Capital One credit card that you have. You earn referral bonus cash or Capital One miles when your friend applies and is approved for that credit card using your referral link.

|

| Photo Credit: Capital One |

| Table of Contents [show/hide] |

|

|

How does Capital One Refer A Friend work?

- You can refer just about anyone to apply for a Capital credit card that you have.

- When the person applies for that particular Capital One credit card using your personal referral link and is approved, you will receive the referral rewards in return.

- If you forget to include your referral link or your friend did not apply for the card using your referral link, you will not earn rewards, and that decision is final.

- Capital One Refer A Friend program limits how many referrals you can refer a Capital One credit card per calendar year (January – December). In other words, if you max out your allowed referrals per calendar year, you will not earn any more referral rewards for that particular credit card until the following calendar year.

- Referral bonus may be subject to tax-related Form 1099-MISC reporting for the year you receive the bonus through Capital One Refer A Friend program.

Who is eligible for Capital One Refer A Friend?

If you’re a Quicksilver, QuicksilverOne, Savor, SavorOne, Venture, VentureOne, Platinum or Secured Mastercard cardholder in good standing, you may qualify for the card referral program. If any of your accounts are closed or in default, you won’t be eligible for the referral program.

How to generate a Capital One credit card referral link?

- Go to the official Capital One Refer-A-Friend website

- Simply click the Sign In to Invite Friends green button and sign in to your Capital One account.

- A popup appears asking you Which account are you trying to service? The question basically asks which credit card you are trying to refer a friend to. Therefore, simply choose the account you wish to generate a referral link.

- Capital One system will generate a unique personal referral link for you to copy along with terms and limits on how many rewards you can earn from referrals. You then can send that link to whoever you want via email, social media, text messages, etc.

Can you refer yourself to a Capital One credit card?

- You do not want to be on bad terms with Capital One and have your accounts involuntarily closed.

- You cannot generate a referral link for a particular Capital One credit card using another card’s referral link, like the Amex Referral program.

- You cannot apply and are approved for the same Capital One credit card.

- Your friend you refer must be a new Capital One customer for that particular credit card.

Can you refer your spouse to a Capital One credit card?

When does the Capital One referral bonus post?

Your account must be open and in good standing to receive a bonus in the referral program. If you upgrade or change your account to another Capital One credit card after you have shared your referral link or while any referred application or bonus is pending, you will not be eligible for a referral bonus. If you have other Capital One credit card accounts that are in default or charged off, you may not be eligible for the referral program. Please allow up to 8 weeks to see any bonus reflected in your account after each referral is approved.

How to keep track of Capital One referrals?

How to see how many Capital One referral bonus rewards you’ve earned?

- Go to the official Capital One Refer-A-Friend website

- Simply click the Sign In to Invite Friends green button and sign in to your Capital One account.

- A popup appears asking you Which account are you trying to service? The question basically asks which credit card you are trying to refer a friend to. Therefore, choose the account you wish to see how many rewards you’ve earned for each approved referral and how many rewards are left available. See the screenshot below:

|

| How to see how many Capital One referral bonus rewards you’ve earned? |

- Log into your Capital One online.

- Pick the Capital One credit card that you want to know about.

- Under the total REWARDS, click on the Redeem button.

- Click on the Earn Activity link.

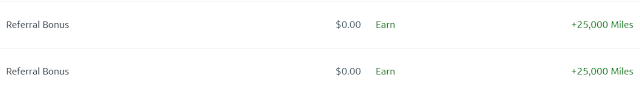

- Scroll and see your referral rewards under the Referral Bonus section if you have any. See the screenshot below.

|

| Keep track of how many Capital One referral bonus rewards you’ve earned. |