- Starting March 31, 2021 – eligible customers will no longer be required to deposit $200 per month to qualify for 4.00% APY. Instead, you’ll need to use your T‑Mobile MONEY card to make 10 qualifying purchases per month as a requirement to earn 4.00% APY.

- IMHO, this change makes the deal no longer worth the effort!

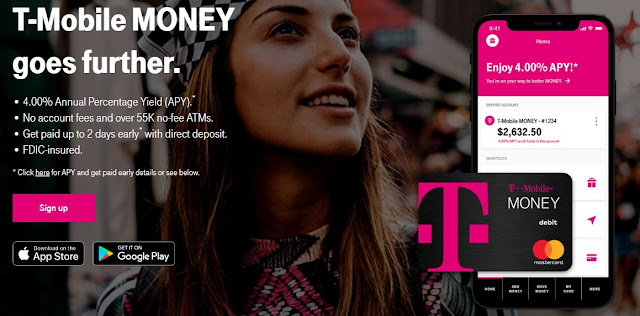

Both T-Mobile and Sprint customers can now apply for the T-Mobile Money which is a checking account program that offers 4% APY interest on balance up to $3,000. 4% interest is a pretty good return nowadays even though the qualifying deposit is capped at $3,000 and there are tasks you have to complete in order to receive that high yield interest. Don’t worry though, the tasks are easy to complete and I’ll walk you through each step in this post.

| Table of Contents [show/hide] |

|

|

T-Mobile Money Review – Earn 4% APY On Balance Up To $3,000

Due to the merger between T-Mobile and Sprint, Sprint customers not only have access to T-Mobile Tuesdays promotion, they are also eligible to sign up for the T-Mobile Money perk and receive 4% APY interest on deposit up to $3,000. Any deposit that is above $3,000 will earn 1% APY, which is still not a bad return.

T-Mobile Money 4.00% APY Requirements

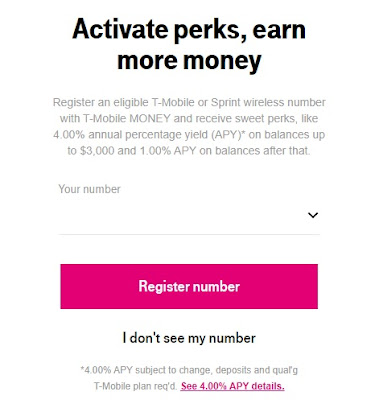

In order to receive 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your checking account per month, you must:

- Be enrolled in a qualifying T-Mobile postpaid wireless plan;

- Have registered for perks with your T-Mobile ID; and

- [UPDATE] Starting March 31, 2021 – eligible customers will no longer be required to deposit $200 per month to qualify for 4.00% APY. Instead, you’ll need to use your T‑Mobile MONEY card to make 10 qualifying purchases per month as a requirement to earn 4.00% APY.

Have at least $200 in qualifying deposits posted to your Checking Account before the last business day of the month.

Is T-Mobile Money Checking Account FDIC Insured?

Yes.

How to Sign Up For T-Mobile Money As A Sprint Customer

- Go to T-Mobile sign up page here.

- Sprint customer needs to click on Create a T-Mobile ID to sign up.

- Go through the registration process. Follow the prompts to finish your registration.

Once the registration is complete and you successfully set up your login ID and password, you will be prompted to register your Sprint phone number. Simply provide your wireless Sprint phone number. See screenshot below. This activates the 4.00% APY perk and will satisfy both the requirement #1 and #2 that are mentioned above. You can also verify this activation under “My Perks” menu.

You can then add money to T-Mobile Money checking account with various methods that can be found under “Add money” menu. Remember you must deposit $200 each month to T-Mobile Money checking account to receive the 4% APY interest. The deposit does not have to be employment’s direct deposit. I recommend you schedule this transfer monthly through T-Mobile Money site/app so that you don’t forget to do it each month. Keep in mind that any balance above $3,000 will earn you 1.00% APY interest.

Once you satisfy all above mentioned 3 requirements, you can go back to “My Perks” menu and verify your 4% APY enrollment status. See screenshot below.

That’s it! Like I said, if you have $3,000 cash that is parked somewhere else that does not give you better return than 4% interest, and you are able to deposit $200 each month into T-Mobile Money account, this is not a terrible idea to save some money for a rainy day.