Advertiser Disclosure: We love living points life by using points and miles to elevate travel experiences. In the interest of being transparent with you, we may be compensated from an approved credit card's application, or from some of the products and services recommended on this site. This only happens when you click on our affiliate links. We also earn commissions from purchases made through Amazon Services LLC Associates Program. Thank you for your support and especially for reading this blog! Please see our Advertiser Disclosure for more details!

American Express is one of the card issuers out there that offer both credit and charge cards. Amex cards are pretty competitive in terms of rewards points and benefits from their no annual fee cards to premium luxury travel cards that have high annual fee. American Express allows consumers to upgrade or downgrade Amex cards without any hard pulls and from time to time, they do send out targeted offer to selected individual to upgrade his/her Amex card.

| Table of Contents [show/hide] |

|

|

How Amex Upgrade Works

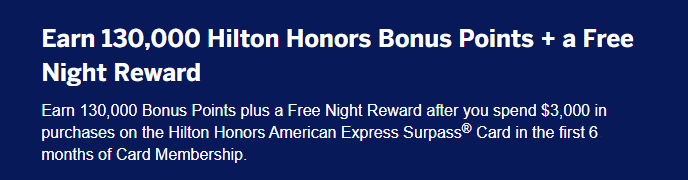

From time to time, American Express sends out targeted offers to upgrade a card for selected card members. For the most part, the targeted “upgrade” offer either appears in the user’s account, by mail, or via email. Alternatively, you can also call Amex up to upgrade your card. However, if you want to upgrade an Amex card, our recommendation is to wait it out until your account is targeted for an offer to upgrade. That is because when you upgrade a card, you are most likely moving to another card that has a higher annual fee. Therefore, it’s best you also receive an offer while paying for the new card’s annual fee. The upgrade offer bonus generally is quite similar to a sign-up welcome bonus if not more. It is also important to know that Amex card upgrade process does not trigger a hard pull on your credit report and you will not lose your account history.

How to Check for Amex Upgrade Offer?

American Express sends out targeted offers to upgrade a card by mail, via email, on phone, and online in user’s account. To check online:

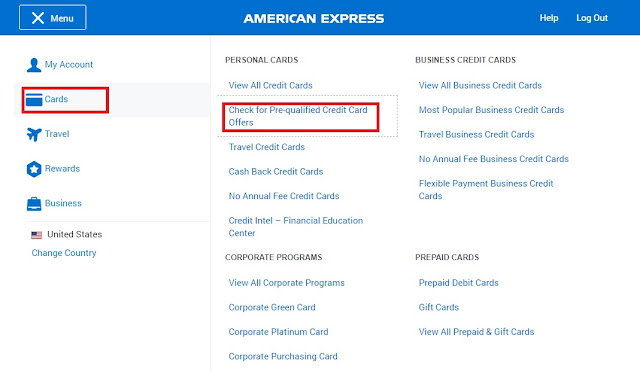

- Sign into your Amex account online.

- Go to Menu, and click on Cards.

- Click on Check for Pre-qualified Credit Card Offers.

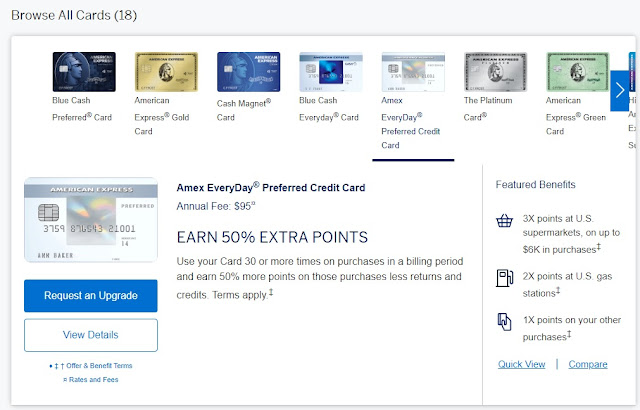

- Scroll down to find a specific card with “Request an Upgrade” button. If an offer is available, it will say so. If not, you won’t see any bonus offer. (See screenshots below).

|

| How to Check for Amex Upgrade Offer? |

|

| Amex Upgrade Does Not Have Offer |

|

| My Amex EveryDay card was targeted for an upgrade to Amex EveryDay Preferred |

Upgraded Card’s Annual Fee

Your new upgraded card’s annual fee will be pro-rated for the rest of your account year. Full new annual fee goes into effect on your next card’s anniversary year.

Upgrade Eligibility

You can only upgrade your Amex card to a specific card. This means that you can only upgrade your Amex card to the same kind of rewards as your old card. You must stay within that card family. For example, you cannot upgrade from an Amex card that earns American Express Membership Rewards (MR) points to a cash back card and vicer versa. Similarly, you cannot upgrade an Amex Marriott credit card to a Hilton credit card, so on and so forth. Moreover, make sure your account is in good standing prior to the upgrade.

Upgrade Benefits

American Express has a strict rule on the limit of credit cards that they allow you to have. Currently, Amex only allows 5 credit cards and 10 charge cards max. If you already max out your credit card slots with Amex, upgrading a card is the way to go because you will not be approved for a new Amex credit card unless you close one of your existing credit cards. That involves calling Amex reconsideration line to sort this out. Moreover, Amex might be hard pulling your credit. Therefore, if you are after bonus points and the targeted upgrade offer is good, it’s better to upgrade than applying for a new card with Amex because you will be able preserve your account history and there’s no hard pull on your credit, plus you will also earn an upgrade bonus points offer.

Does Upgrade Count Against Amex’s Once-Per-Lifetime Bonus Rule?

Yes. American Express makes it clear in their card’s application terms with the following wording:

Welcome offer not available to applicants who have or have had this or previous versions of this Card.

In other words, once you upgrade your Amex card, you are going to be considered “have had this card” and thus makes you ineligible for any sign-up bonus of that card again in the future. That’s why it is important that if you want to upgrade a card, make sure you receive a targeted upgrade offer that is acceptable and comparable to a new sign-up bonus.

Editor’s Note: Sometimes Amex card’s application term does not contain once-per-lifetime language. If that’s the case, you may sign up for the card and receive the welcome bonus again.

Can You Downgrade Back to the Old Card?

Absolutely. However, please keep in mind that American Express does not like if you are gaming their offers. American Express makes it clear below:

If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome offer(s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit Membership Rewards® points to, we may freeze Membership Rewards® points credited to, or we may take away Membership Rewards® points from your account. We may also cancel this Card account and other Card accounts you may have with us.

The gist of it is, you can certainly downgrade back to the old card, but if you do it too fast, you may be at risk losing the upgrade bonus points and your relationship with American Express. A good rule of thumb is to wait until the year mark before requesting the downgrade.

See Also:

- Master List of Airline Status Match Challenge (2025) - April 25, 2025

- Full List of Hyatt Promotions and Offers (2025) - April 25, 2025

- Full List of Amazon Shop With Points Promotions and Offers (2025) - April 25, 2025