Yesterday, I decided to apply for the Barclay Arrival Plus and AAdvantage Aviator Business credit cards. Although the outcome did not go as what I hoped, I am happy to share with readers on the data points as the results from those two applications with Barclay. In the end, I could not get approved for the Arrival Plus but I got the AAdvantage Aviator Business Mastercard approved.

Here are the data points:

1. Barclay Arrival Plus Auto-Denied by the System

If you hold the no annual fee Barclay Arrival credit card and you apply for a Barclay Arrival Plus credit card, you will receive the “under review” message. If you call in the reconsideration line 866-408-4064, you will be told that the application is auto-denied by the system because the system considers the Arrival Plus is the same product as the no annual fee Arrival. They are in fact not considered the same products, and therefore the agent can pull the application back and manually reviews it with your permission.

2. Unofficial Barclay 6/24 Rule?

I am just going to call this 6/24 rule based on my personal experience for now. The agent could not approve me for the Arrival Plus card and stated that I have 7 credit cards within the last 24 months. In order to be re-considered for future credit application, I have to wait until my credit report shows the number of cards under 6 in the past 24 months.

3. Merged Inquiry on Personal and Business Credit Card Applications

After attempting to apply for both Barclay’s personal and business credit cards on the same day, my credit report shows that the inquiry does get merged. My TransUnion shows only one new credit inquiry from Barclay.

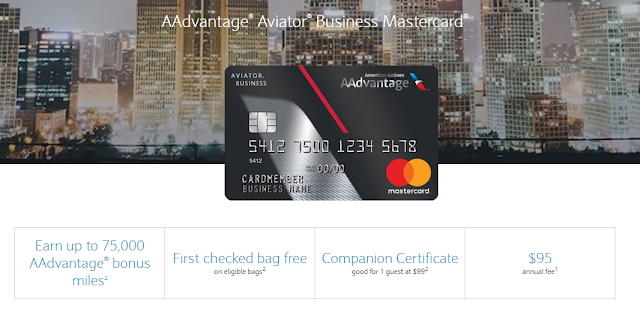

4. Personal Card Declined, Business Card Approved

It was discouraging at first that since my Barclay’s personal credit card application did not get approved, I shouldn’t try the Business credit card with Barclay either. However, I did not want to waste the hard inquiry per item #3 above, so I decided to apply for the 75,000 welcome bonus Barclay’s AAdvantage Aviator Business Mastercard as well. The application went to under review as well, so I had to call in to talk to an agent about the application. She had to ask me a few questions about my business, business income and my personal income. After all that along with reviewing my credit report, she had to allocate some of my credits from my personal credit card to the AAdvantage Aviator Business Mastercard, in the end I was approved. Perhaps, Barclay is more strict when it comes to their own credit card product and thus they won’t approve if an application has too many credit cards in the past 24 months.